As part of it’s deregulation agenda, the Australian Government states it is “committed to improving the quality of its regulation, including minimising the burden of regulation on businesses, community organisations and individuals”. I’m not so sure this is true.

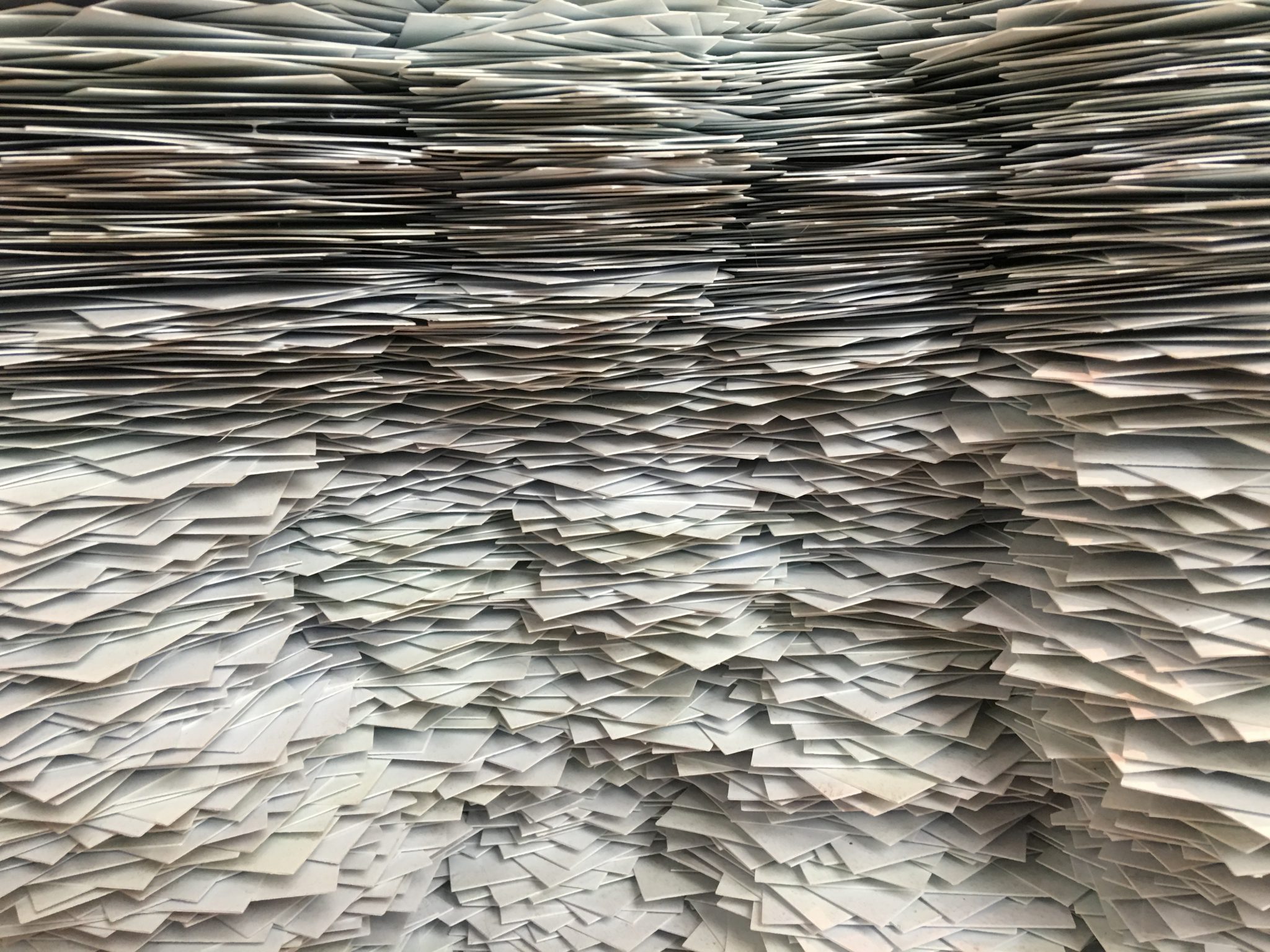

Compliance reporting requirements are increasing and this in turn is raising costs of operating a small business.

Single Touch Payroll (STP) is an initiative being introduced by the Australian Tax Office (ATO) to provide real time visibility over the accuracy and timeliness of payroll processes.

Single Touch Payroll (STP) is a reporting change for employers. It starts from 1 July 2018 for employers with 20 or more employees. These employers are required to report payments such as salaries and wages, pay as you go (PAYG) withholding and superannuation information from their payroll solution each time they pay their employees.

Single Touch Payroll (STP) is expected to expand to all employers by 1 July 2019, however legislation is yet to be passed.

In the ATO’s view STP proposes to streamline the administration of employee payroll, tax and superannuation obligations for employers.

I have my doubts. As it stands, when a bookkeeper/BAS agent or Accountant lodges any information to the ATO s/he must get a signed lodgement authorisation from their client. Although in many cases this is now done electronically, not everyone has the skills, capability or understanding of on line systems.

Lets take this to the next step and look at an example for Single Touch Payroll (STP).

You run a small business that employs staff. Your bookkeeper/BAS agent does your administration and processes your payroll. If you are like most small businesses in Australia and pay your staff weekly, under Single Touch Payroll (STP) rules you will be required to report payments such as salaries and wages, pay as you go (PAYG) withholding and superannuation at the end of each pay event. In this case weekly.

The ATO legal requirement as it currently stands means that your BAS Agent or Accountant will need a signed client authority/declaration form each time they report a payroll information to the ATO (each pay event). You as a small business owner are expected to sign an authorisation for lodgements of your reports each and every single time. That is 52 additional signatures each year.

This is not what I would call a reduction in RED TAPE.

Small business, who all the politicians spruik as “the engine room of the economy” are Australia’s largest employers and largest contributors to GDP. Over 2 million businesses, sole traders, partnerships, trusts and small employers – have helped underpin 25 years of continuous economic growth.

Small businesses employ a lot of people. Over 65% of all private sector employment is by small business.

They are now being asked to multiply their reporting burden 10 fold. For a small business this is not a good use of limited resources or a reduction in bureaucratic red tape. At the end of the day, no matter what software or systems or resources they use, their compliance costs will increase substantially.

For some small businesses this will be an unsustainable and costly exercise which could result in closures.

From a bookkeeper and accountant perspective this is great news for increased revenue and may even result in additional employment in chasing clients for signatures.

In my view, the ATO has some serious thinking and work to do in cutting red tape and reducing the cost of compliance.